The United Kingdom’s (UK) consumer price index (CPI) rose to 10.4 percent in the 12 months to February 2023 from 10.1 percent in January, the Office for National Statistics (ONS) said on Wednesday.

The 10.4 percent increase was higher than 9.9 percent forecast by economists polled by Reuters, dampening expectations of a sharp fall in inflation. Inflation had fallen in three months from a 41-year high of 11.1 percent in October 2022.

Commenting on the CPI figures, ONS chief economist Grant Fitzner said inflation was mainly driven by rising alcohol prices in pubs and restaurants after January discounts. “Food and soft drink prices rose to their highest levels in more than 45 years, with some salads and vegetables notably rising as high energy costs and bad weather in parts of Europe led to shortages and rationing,” he said.

Downward contributors came from falling fuel costs, with the annual rate of inflation declining for seven straight months, according to Finer.

The surprise hike has put pressure on the Bank of England to hike rates again. Policymakers will announce their decision on Thursday.

Kitty Usher, chief economist at the Institute of Directors, said: “In recent days, some have suggested that the fevered environment in the banking sector should give central banks a break before raising rates further”. Today’s Bank of England data suggests otherwise – the work is not done yet.

The central bank has been raising interest rates since December 2021 to counter rising inflation.

- Consumer price inflation data

- Glossary

- Measuring the data

- Strengths and limitations

- Related links

- Cite this statistical bulletin

Print this statistical bulletin

1.Main points

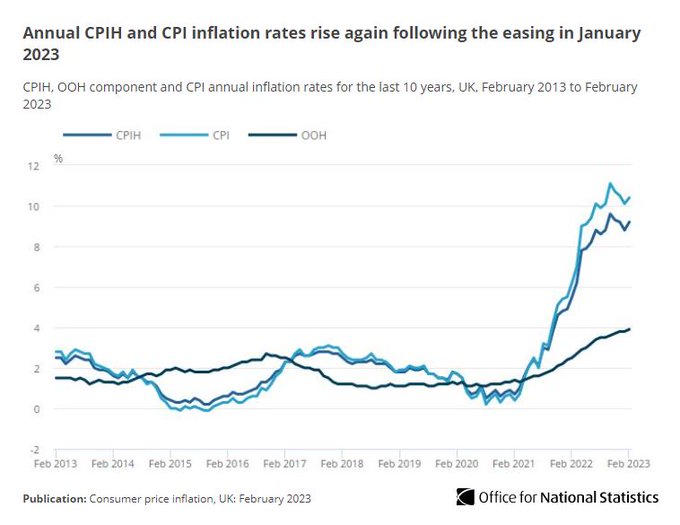

- The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 9.2% in the 12 months to February 2023, up from 8.8% in January.

- The largest upward contributions to the annual CPIH inflation rate in February 2023 came from housing and household services (principally from electricity, gas, and other fuels), and food and non-alcoholic beverages.

- On a monthly basis, CPIH rose by 1.0% in February 2023, compared with a rise of 0.7% in February 2022.

- The Consumer Prices Index (CPI) rose by 10.4% in the 12 months to February 2023, up from 10.1% in January.

- On a monthly basis, CPI rose by 1.1% in February 2023, compared with a rise of 0.8% in February 2022.

- The largest upward contributions to the monthly change in both the CPIH and CPI rates came from restaurants and cafes, food, and clothing, partially offset by downward contributions from recreational and cultural goods and services (particularly recording media), and motor fuels.

- The estimates for February 2023 have been constructed using updated expenditure weights; this is the second and final weights update for 2023.

- This release is the first publication to include expanded data on rail fares as part of our project to transform consumer price statistics.

(With inputs from agencies)

A global media for the latest news, entertainment, music fashion, and more.

Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 9.2% in the 12 months to Feb 2023, up from 8.8% in Jan 2022

Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 9.2% in the 12 months to Feb 2023, up from 8.8% in Jan 2022