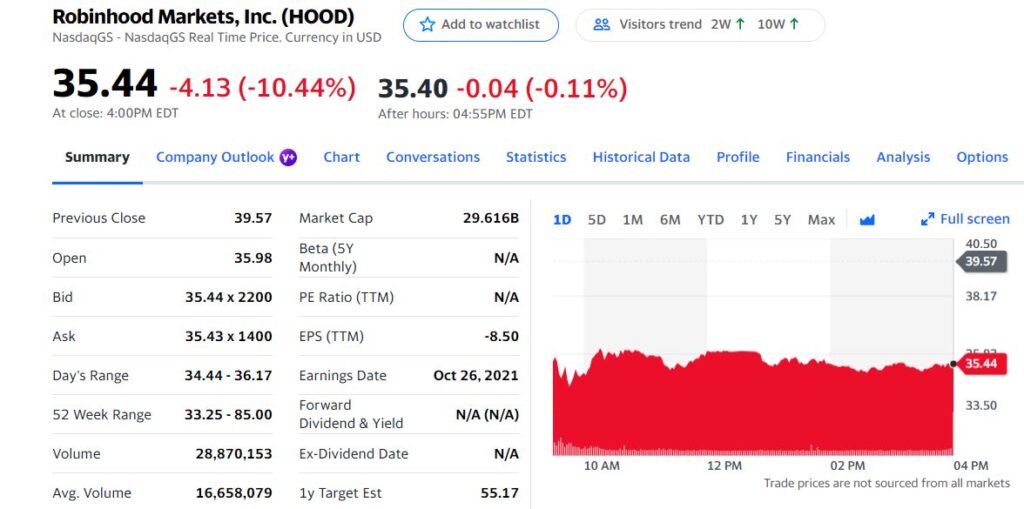

Robinhood’s share down by 10.44% on Wednesday close after its third-quarter results missed analyst estimates on revenue.

Robinhood’s third-quarter earnings missed analysts’ estimates, sending the stock down. The losses were mostly due to crypto activity declining from record highs in the prior quarter. The stock was down 9% this morning and closed with 10.44%.

Total revenue was $364.9 million, according to a financial release by Robinhood, missing the $423.9 million estimate of 10 analysts surveyed by Bloomberg. Third-quarter transaction-based revenue totaled $267 million, with only $51 million coming from cryptocurrency trading, according to the release.

According to the release, crypto activity declined from record highs in the prior quarter, leading to considerably fewer new funded accounts, a slight decline in net cumulative funded accounts, and lower revenue in the third quarter of 2021 compared with the second quarter of 2021.

“This quarter was about developing more products and services for our customers, including crypto wallets,” Vlad Tenev, CEO and Co-Founder of Robinhood Markets said in the release.

“More than one million people have joined our crypto wallets waitlist to date. With 24/7 live phone support, we believe that Robinhood is becoming the most trusted and intuitive platform for retail and crypto investors. And looking ahead, we’re committed to delivering tax-advantaged retirement accounts to help everyone invest for the long term,” Tenev added.

According to Robinhood, financial results for the third quarter ended September 30, 2021.

- Total net revenues increased 35% to $365 million, compared with $270 million in the third quarter of 2020.

- Transaction-based revenues increased 32% to $267 million, compared with $202 million in the third quarter of 2020.

- Options increased 29% to $164 million, compared with $127 million in the third quarter of 2020.

- Cryptocurrencies increased 860% to $51 million, compared to $5 million in the third quarter of 2020.

- Equities decreased 27% to $50 million, compared with $69 million in the third quarter of 2020.

- Loss before income tax was $1.37 billion, compared with loss before income tax of $11 million in the third quarter of 2020. Share-based compensation expense totaled $1.24 billion in the third quarter of 2021 of which $1.01 billion was recognized upon our IPO.

- Net loss was $1.32 billion, or $2.06 per diluted share, compared with net loss of $11 million, or $0.05 per diluted share in the third quarter of 2020.

- Adjusted EBITDA (non-GAAP) was negative $84 million, compared with positive $59 million in the third quarter of 2020.

- Net Cumulative Funded Accounts increased 97% to 22.4 million, compared with 11.4 million in the third quarter of 2020.

- Monthly Active Users (MAU) increased 76% to 18.9 million, compared with 10.7 million in the third quarter of 2020.

- Assets Under Custody (AUC) increased 115% to $95 billion, compared with $44 billion in the third quarter of 2020.

- Average Revenues Per User (ARPU) decreased 36% to $65, compared with $102 in the third quarter of 2020.

- Crypto activity declined from record highs in the prior quarter, leading to considerably fewer new funded accounts, a slight decline in Net Cumulative Funded Accounts, and lower revenue in the third quarter of 2021 compared with the second quarter of 2021.

A global media for the latest news, entertainment, music fashion, and more.