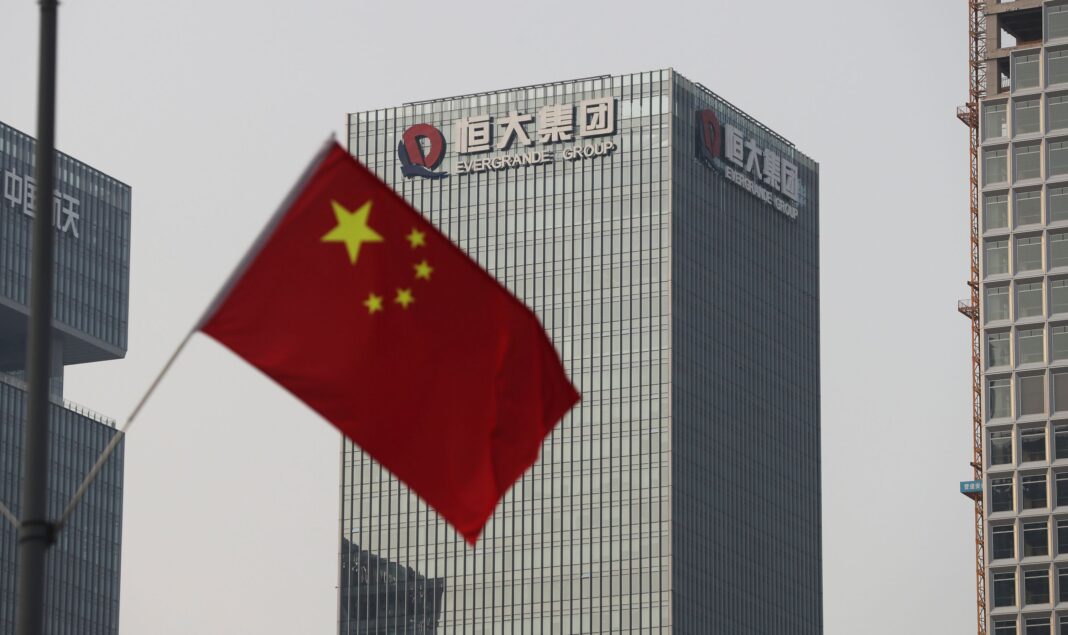

China Evergrande Group, a major property developer facing financial turmoil, has resumed trading in its shares after a 17-month suspension on Monday. This move has garnered significant attention given the tumultuous state of China’s property sector, characterized by debt defaults that have reverberated in financial markets. As Evergrande’s shares dropped by a staggering 86.7% upon resuming trading, the challenges it confronts have become clear, impacting both domestic and international stakeholders.

Key Points:

- The reentry of Evergrande’s shares onto the Hong Kong Stock Exchange is a crucial moment amidst a crisis affecting China’s property sector since late 2021.

- The company faces immense debt and has been hit by a series of defaults that have raised concerns about the stability of China’s property market.

- Evergrande’s shares plummeted by 86.7% as trading resumed, highlighting the severity of its challenges.

- The company’s massive debt load has led to its position as the world’s most-indebted property developer.

- Evergrande aims to restructure offshore debts by converting some into equity-linked instruments supported by subsidiaries.

- The drop in share value to HK$0.22, from the suspension in March 2022, emphasizes the company’s struggle.

- A small positive note is Evergrande’s narrower net loss in H1 2023, attributed to increased revenue.

- The company’s journey forward remains uncertain as it navigates debt defaults, restructuring, and the need to rebuild investor trust. The outcome holds implications for China’s property sector and the global financial landscape.

A global media for the latest news, entertainment, music fashion, and more.