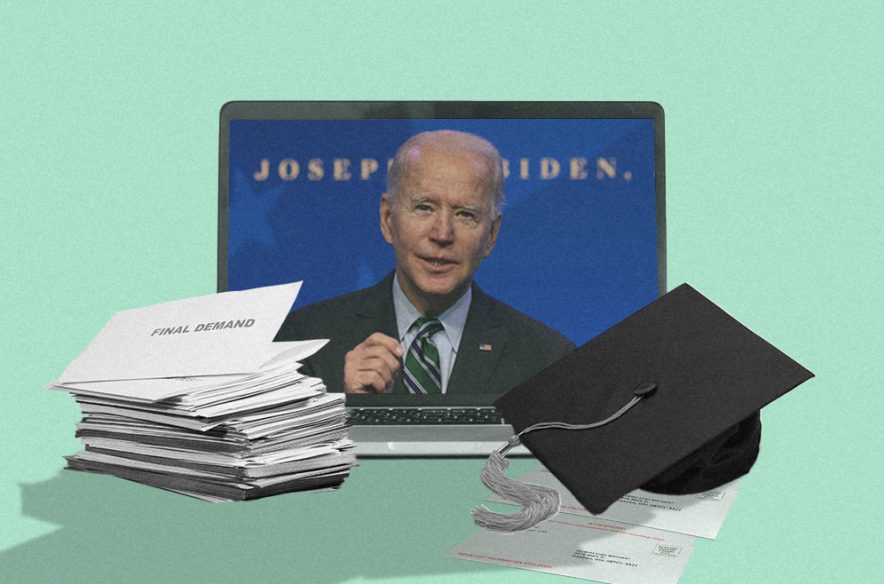

The Biden administration has extended the pause on federal student loan payments for the last time until January 31, 2022.

The U.S. Department of Education (DOE) announced Friday a final extension of the pause on student loan repayment, interest, and collections until January 31, 2022.

The pandemic relief benefit was set to expire on September 30 after an unprecedented 19-month suspension. The freeze was initially put in place by Congress and then extended by both the Trump and Biden administrations.

The DOE believes this additional time and definitive end date will allow borrowers to plan for the resumption of payments and reduce the risk of delinquency and defaults after the restart, the Department said.

The Department will continue its work to transition borrowers smoothly back into repayment, including by improving student loan servicing, the DOE said in a statement.

“The payment pause has been a lifeline that allowed millions of Americans to focus on their families, health, and finances instead of student loans during the national emergency,” U.S. Secretary of Education Miguel Cardona said in the statement.

“As our nation’s economy continues to recover from a deep hole, this final extension will give students and borrowers the time they need to plan for restart and ensure a smooth pathway back to repayment. It is the Department’s priority to support students and borrowers during this transition and ensure they have the resources they need to access affordable, high-quality higher education,” Cardona added.

According to the DOE, it will begin notifying borrowers about this final extension in the coming days, and it will release resources and information about how to plan for payment restart as the end of the pause approaches.

The DOE said that today’s action is one of a series of steps it has taken to support students and borrowers, make higher education more affordable, and improve student loan servicing, including:

- Approving $1.5 billion in borrower defense claims, including extending full relief to approved claims and approving new types of claims.

- Reinstating $1.3 billion in loan discharges for 41,000 borrowers who received a total and permanent disability discharge and protecting another 190,000 from potential loan reinstatement.

- Helping 30,000 small business owners with student loans seeking help from the Paycheck Protection Program.

A global media for the latest news, entertainment, music fashion, and more.